Tax Calculation In Cargospot

The tax applied to an air waybill is dependent on either the hard-coded taxes in the Country settings screen and the records created in the Tax Calculation screen. However, if created records in the Tax Calculation screen overlap with the hard-coded taxes, both taxes will be added to the AWB unless it is specified that the Tax Calculation record should override the hard-coded values.

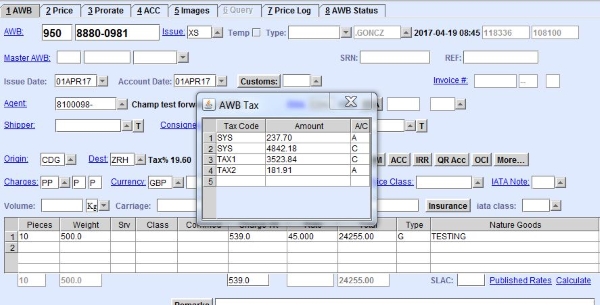

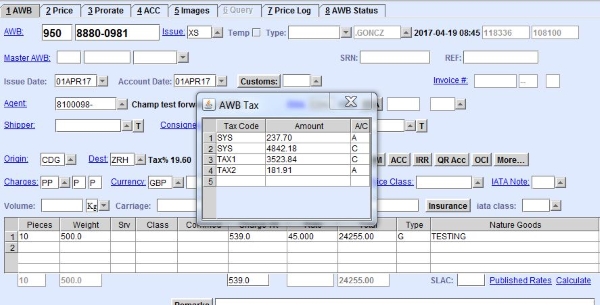

In the following example, several taxes have been applied to the air waybill.

EU taxes hard-coded in the system

EU taxes that have been applied to an AWB appear with the Tax Code, SYS. In this example, the taxes were taken from the defined percentage of 19.60 for France. This percentage is shown beside the Origin/Destination fields.Tax Calculation Screen

Taxes applied based on records created in the Tax Calculation screen appear with the Tax Code specified for the applicable records. In this example, the tax codes applied are TAX1 and TAX2. Both tax calculation records were not defined to Override System Calculated Taxes.It is recommended to ensure that created tax calculation have Override System Calculated Taxes selected. When selected, all hard-coded tax values (SYS) are set to zero.