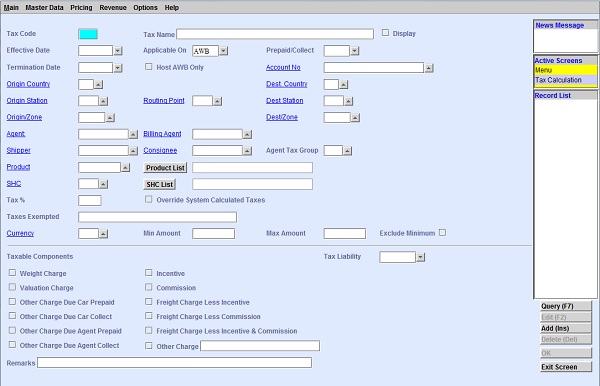

Tax Calculation Screen

The Tax Calculation screen contains all relevant parameters for a particular tax code record.

Tax codes configured in the system allow tax calculation relatively independent to changes in tax percentage and structure. These tax codes also provide flexibility in setting up the posting in the manual journal voucher.

The Tax Calculation screen can be found in .

The fields in the Tax Calculation screen function as an additional tax differentiator in the

system. Tax calculations may vary depending on the origin, destination, or a combination of both.

You can use the Tax Liability drop-down menu to apply the tax calculation

to the agent, carrier, or the receiving agent. Depending on the set Tax Liability, specific

Taxable Components can be applied to the agent or carrier. You can select at least one of

the available tax components in the system:

- Weight Charge

- Valuation Charge

- Other Charge Due Car Prepaid

- Other Charge Due Car Collect

- Other Charge Due Agent Prepaid

- Other Charge Due Agent Collect

- Incentive

- Commission

- Freight Charge Less Incentive

- Freight Charge Less Commission

- Freight Charge Less Incentive & Commission

- Other Charge